Static QR Code allows you to add a printed static QR code to your point of sale (PoS) and link it to your cash register system. Your PoS sends the payment information to the QR code, your consumers scan the QR code with their preferred payment application and confirm the transaction.

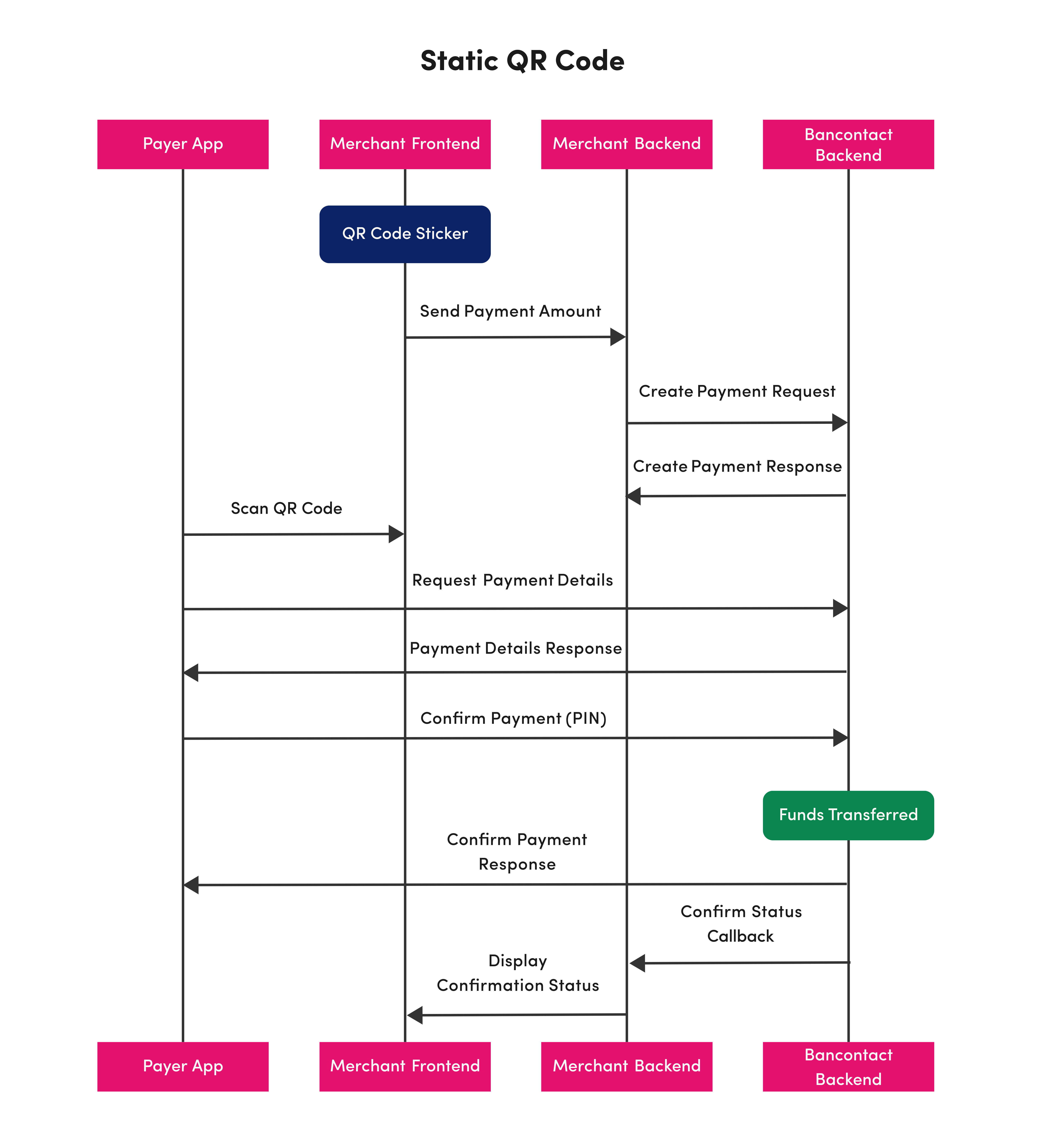

The following section outlines the key steps involved in a Static QR Code payment with Bancontact Payconiq. The process involves several key parties, each playing a specific role in completing the transaction.

- API Key – This is used to secure the request between the Merchant’s backend and Bancontact Payconiq’s backend. Do not share your API keys in public areas such as online sites or client-side code.

- Merchant CallbackUrl (Optional) – This URL will be called by Payconiq’s backend servers in order to send the status of the payment to the merchant.

The following parties participate in a display-based in-store payment with Bancontact Payconiq:

- Payer Application: The consumer's preferred payment app used to complete the transaction.

- Merchant Frontend: The printed static QR code

- Merchant Backend: The merchant’s server-side system that integrates with Bancontact Payconiq.

- Bancontact Payconiq Backend: The backend system responsible for handling payment processing and integration services.

This section outlines a typical “Static QR Code” in-store payment flow using Bancontact Payconiq. The process begins when the transaction is initiated at the merchant’s location and ends when both the merchant and the consumer receive the final confirmation.

- The Merchant frontend displays a Static QR code, visible to the consumers.

- The Merchant backend issues a REST request to the Bancontact Payconiq backend to create the payment, providing parameters like amount, currency, description, and other relevant parameters.

- The Bancontact Payconiq backend responds with the created payment ID and other relevant detail to the Merchant backend

- The Payer app scans the QR code to initiate the payment process.

- The Payer app sends a request for payment details to the Bancontact Payconiq backend. The POS ID present in the Static QR is matched with a POS ID on Bancontact Payconiq backend.

- Bancontact Payconiq backend sends the payment details tot he Payer App, which contains the name of the merchant and the amount to pay.

- The consumer confirms the payment n the Payer app using PIN, fingerprint, or face ID. The Payer app then submits the payment request to the Bancontact Payconiq backend for authorization.

- A payment response is sent back by the Bancontact Payconiq backend to the Payer App, indicating whether the payment was successful or failed.

- The Bancontact Payconiq backend sends a payment notification with the payment status to the merchant backend via the configured callback URL.

- The merchant frontend displays the payment status.

Important Note: The order in which the merchant and consumer receive payment status notifications is not guaranteed. Network and connectivity differences may cause one party to receive the update before the other.

In the following diagrams you will find a visual overview of the process flows presented above:

For the full endpoint documentation, please refer to the Merchant Payment API.

In order to create a Static QR code you need to use the Bancontact Payconiq service URL as illustrated below. Once created, you will be able to print the Static QR on the medium of your choice.

The QR code contains the following parameters:

| Attribute | Description |

|---|---|

f [String :: Enum] Allowed Values: SVG, PNG | Image format. If not provided, the default format is PNG. |

s [String :: Enum] Allowed Values: S, M, L, XL | Image size of the QR code to generate. Small (S) = 180x180 Medium (M) = 250x250 Large (L) = 400x400 Extra Large (XL) = 800x800 The sizes only applies to PNG format. *If not provided, the default size is Small. |

c [String, required] | The Payconiq UTF-8 URL encoded content. This is comprised of the location URL scheme. |

cl [String :: Enum] Allowed Values: magenta, black | The colour of the QR code. Default is magenta. |

| Activity | Comment |

|---|---|

| 1. Obtain the pre-requisite information |

• Format of the Payconiq QR code. • Size of the Payconiq QR code. • Location URL scheme. • Payment profile ID of the merchant. • POS ID. |

| 2. Build the Payconiq service URL |

Sample format:https://qrcodegenerator.api.bancontact.net/qrcode?f={imageFormat}&s={ImageSize}&c=Example Output URL (PNG): https://qrcodegenerator.api.bancontact.net/qrcode?f=PNG&s=L&c=Sample URL (SVG): https://qrcodegenerator.api.bancontact.net/qrcode?f=SVG&c= |

| 3. UTF-8 encode Payconiq URL parameters |

Encode the following using UTF-8: • POS ID Unencoded POS ID: POS00001Encoded POS ID: POS00001 |

| 4. Build the Payconiq URL payload |

Format:https://payconiq.com/l/1/{PaymentProfileId}/{POSId}Example: https://payconiq.com/l/1/5bb37284e35e2b29e363df22/POS00001 |

| 5. UTF-8 encode the URL payload |

Before Encoding:https://payconiq.com/l/1/5bb37284e35e2b29e363df22/POS00001After Encoding: https%3A%2F%2Fpayconiq.com%2Fl%2F1%2F5bb37284e35e2b29e363df22%2FPOS00001 |

| 6. Combine service URL and encoded payload |

Full URL:https://qrcodegenerator.api.bancontact.net/qrcode?f=PNG&s=XL&c=https%3A%2F%2Fpayconiq.com%2Fl%2F1%2F5bb37284e35e2b29e363df22%2FPOS00001 |

You can now execute the URL in a web view to obtain your Static QR Code and print it on the medium of your choice.

In order to initiate a payment, you will first have to create it through Bancontact Payconiq via a POST request. Each request will result in a unique payment identifier which will be valid for two minutes (120 seconds).

If the payment does not take place within these two minutes, a new payment must be created.

Partner payment reference, used to reference the Bancontact Payconiq Company payment in the partner's system

Field used to reference a bulk batch, so the merchant can inform how the payments should be bulked. If it's not set here it will default to the one configured in the profile.

Amount in cents requested

Description of the payment that will be shown to the debtor, also used in the bank statement for reconciliation purposes. The characters used must comply with the SEPA Requirements for an Extended Character Set (UNICODE Subset) - Best Practices | European Payments Council.

Merchant's point of sale identifier

Id of the shop, where payment is created

Name of the shop, where payment is created. This name will be shown to the user during payment, but will be truncated in the remittance info, if longer than 23 characters.

Callback url to which merchants will be notified about the payment identification. If it's not set here it will default to the one configured in the profile

Callback url to which the merchant will be notified about the payment payout/cancel. If it's not set here it will default to the one set in the profile

List of Value Added Services (vouchers) eligible amounts within the payment

Payment ID

the status of the payment created

the creation time of the payment

the time from which the payment will be expired

Description of the payment that will be shown to the debtor, also used in the bank statement for reconciliation purposes. The characters used must comply with the SEPA Requirements for an Extended Character Set (UNICODE Subset) - Best Practices | European Payments Council. Only first 35 characters will be used for the remittance info

Merchant payment reference, used to reference the Bancontact Payconiq Company payment in the merchant's system. The characters used must comply with the SEPA Requirements for an Extended Character Set (UNICODE Subset) - Best Practices | European Payments Council.

Amount in cents requested

Currency code. Only EUR is supported ISO 4217

Creditor account set to receive the payment

The configuration ID of the Merchant

the Id of the merchant

Merchant's company name that will be shown to the debtor

Creditor's Bank Account Iban to where the money will be sent to for this current payment

callbackUrl to which the merchant will be notified about the payment identification

callbackUrl to which the merchant will be notified about the payment payout

Provides information to navigate to our REST interfaces dynamically, by including hypermedia links to them. Note that for some links inclusion depends on the status of the payment (e.g. cancel link will be available on PENDING and refund on SUCCEEDED)

| HTTP Status | Code | Meaning |

|---|---|---|

| 400 | BODY_MISSING | A json needs to be provided |

| 400 | FIELD_IS_REQUIRED | Field X is mandatory |

| 400 | FIELD_IS_INVALID | Field X is invalid |

| 401 | UNAUTHORIZED | user doesn’t have an access token |

| 403 | ACCESS_DENIED | The JWT could not be verified (different format) - The JWT doesn’t contain the required authority to access the resource requested |

| 404 | MERCHANT_PROFILE_NOT_FOUND | The merchant profile does not exist |

| 422 | UNABLE_TO_PAY_CREDITOR | Variable reason(Depends on automatic processing). |

| 500 | TECHNICAL_ERROR | Technical error in Payment service |

| 503 | TRY_AGAIN_LATER | one of the internal services is unavailable |

- PREPROD merchant APIhttps://merchant.api.preprod.bancontact.net/v3/payments/pos

- PROD merchant APIhttps://merchant.api.bancontact.net/v3/payments/pos

- curl

- JavaScript

- Node.js

- Python

- Java

- C#

- PHP

- Go

- Ruby

- R

- Payload

curl -i -X POST \

https://merchant.api.preprod.bancontact.net/v3/payments/pos \

-H 'Authorization: YOUR_API_KEY_HERE' \

-H 'Content-Type: application/json' \

-d '{

"reference": "19848995",

"bulkId": "Bulk-1-200",

"amount": 1,

"currency": "EUR",

"description": "string",

"posId": "POS00001",

"shopId": "3418e946-ef71-41ef-ad56-c41421c1e079",

"shopName": "Bun café",

"identifyCallbackUrl": "https://api.merchant.bancontact.net/identify",

"callbackUrl": "https://api.merchant.bancontact.net/payment",

"voucherEligibility": [

{

"voucherSchemes": [

"BEL_MEAL_VOUCHER"

],

"amount": 1013

}

]

}'You can specify a callback URL where the Bancontact Payconiq backend will send notifications about the status of a payment. This will allow you to take appropriate action and process the payment data.

The merchant backend must verify that the notification message originated from Bancontact Payconiq backend was not altered or corrupted during the tranmission. To do so, please ensure signature validation.

For the full Callback documentation, please refer to the Callback Guide.

PaycBancontact Payconiq Company Payment ID

Only EUR is supported currently

Requested amount in cents

Description of the payment that will be shown to the debtor, also used in the bank statement for reconciliation purposes. The characters used must comply with the SEPA Requirements for an Extended Character Set (UNICODE Subset) - Best Practices | European Payments Council.

Merchant payment reference, used to reference the Bancontact Payconiq Company payment in the merchant’s system. The characters used must comply with the SEPA Requirements for an Extended Character Set (UNICODE Subset) - Best Practices | European Payments Council.

When the payment was created

When the payment is going to expire. After that date the payment can't be confirmed anymore

if the payment is SUCCEEDED, then this field represents the date-time on which the payment was SUCCEEDED

| Status | Description |

|---|---|

| PENDING | The merchant has created the payment and and is pending to proceed with identify step. |

| IDENTIFIED | The user has scanned the payment's QR code with the Payconiq By Bancontact APP. |

| AUTHORIZED | The user has confirmed the payment and the bank authorized it. |

| AUTHORIZATION_FAILED | The authorization with the bank failed. |

| FAILED | Something went wrong during the payment process(e.g authorization failed). |

| SUCCEEDED | The payment has succeeded. |

| CANCELLED | When the payment has been canceled after the user has scanned it, or the merchant has cancelled the payment. |

| EXPIRED | The payment has expired. |

| PENDING_MERCHANT_ACKNOWLEDGEMENT | The payment is waiting for the merchant to acknowledge. |

| VOIDED | The payment has been voided |

Customer that paid

Debtor's IBAN masked

Debtor's first name

(No defined response schema)

- PREPROD merchant APIhttps://merchant.api.preprod.bancontact.net/callback

- PROD merchant APIhttps://merchant.api.bancontact.net/callback

- curl

- JavaScript

- Node.js

- Python

- Java

- C#

- PHP

- Go

- Ruby

- R

- Payload

curl -i -X POST \

https://merchant.api.preprod.bancontact.net/callback \

-H 'Content-Type: application/json' \

-H 'Signature: YOUR_API_KEY_HERE' \

-H 'User-Agent: Payconiq' \

-d '{

"paymentId": "5f91483d-78a7-4914-bc6f=",

"currency": "EUR",

"amount": 0,

"description": "string",

"reference": "19848995",

"createdAt": "2019-08-24T14:15:22Z",

"expireAt": "2019-08-24T14:15:22Z",

"succeededAt": "2019-08-24T14:15:22Z",

"status": "PENDING",

"debtor": {

"iban": "*************12636",

"name": "John"

}

}'In the event you do not receive a callback or the callback validation fails, please refer to "Get Payment Details". This alternative will also allow you to confirm the status of a transaction in order to complete the payment.

By calling this endpoint you can obtain the details of an existing payment transaction by passing the unique payment ID.

Note: it is highly recommended to implement this call as a fallback option if callback fails.

id(string, required)

id of the payment

the creation time of the payment

the time from which the payment will be expired

if the payment is SUCCEEDED, then this field represents the date-time on which the payment was SUCCEEDED

Currency code. Only EUR is supported ISO 4217

| Status | Description |

|---|---|

| PENDING | The merchant has created the payment and and is pending to proceed with identify step. |

| IDENTIFIED | The user has scanned the payment's QR code with the Payconiq By Bancontact APP. |

| AUTHORIZED | The user has confirmed the payment and the bank authorized it. |

| AUTHORIZATION_FAILED | The authorization with the bank failed. |

| FAILED | Something went wrong during the payment process(e.g authorization failed). |

| SUCCEEDED | The payment has succeeded. |

| CANCELLED | When the payment has been canceled after the user has scanned it, or the merchant has cancelled the payment. |

| EXPIRED | The payment has expired. |

| PENDING_MERCHANT_ACKNOWLEDGEMENT | The payment is waiting for the merchant to acknowledge. |

| VOIDED | The payment has been voided |

Creditor account set to receive the payment

The configuration ID of the Merchant

the Id of the merchant

Merchant's company name that will be shown to the debtor

Creditor's Bank Account Iban to where the money will be sent to for this current payment

callbackUrl to which the merchant will be notified about the payment identification

callbackUrl to which the merchant will be notified about the payment payout

Amount in cents originally requested. If no amount was requested by creditor, this will be 0

merchant's description of the payment

debtor's message of the payment

Merchant payment reference, used to reference the Bancontact Payconiq Company payment. The characters used must comply with the SEPA Requirements for an Extended Character Set (UNICODE Subset) - Best Practices | European Payments Council. in the merchant's system

Field used to reference a bulk batch, so the merchant can choose how to bulk the payments. Mandatory if merchant profile does have bulking enabled, otherwise will miss from the response. If it's not set in the create call it will default to the value configured in the profile if it exists, otherwise its value will be defaulted by the application.

Provides information to navigate to our REST interfaces dynamically, by including hypermedia links to them. Note that for some links inclusion depends on the status of the payment (e.g. cancel link will be available on PENDING and refund on SUCCEEDED)

| HTTP Status | Code | Meaning |

|---|---|---|

| 401 | UNAUTHORIZED | caller doesn’t have an api-key access token |

| 403 | ACCESS_DENIED | api-key access token is invalid, creditor is not a participant of the requested payment |

| 404 | PAYMENT_NOT_FOUND | no payment could be found |

| 500 | TECHNICAL_ERROR | Technical error in Payment service |

- PREPROD merchant APIhttps://merchant.api.preprod.bancontact.net/v3/payments/{id}

- PROD merchant APIhttps://merchant.api.bancontact.net/v3/payments/{id}

- curl

- JavaScript

- Node.js

- Python

- Java

- C#

- PHP

- Go

- Ruby

- R

- Payload

curl -i -X GET \

'https://merchant.api.preprod.bancontact.net/v3/payments/{id}' \

-H 'Authorization: YOUR_API_KEY_HERE'You can also retrieve a list of payments by specifying how many records to return, as well as a filter on the results for the total number of records returned per page.

default is today - 1day (yesterday)

Merchant payment reference, used to reference Bancontact Payconiq Company payment in merchant system. The characters used must comply with the SEPA Requirements for an Extended Character Set (UNICODE Subset) - Best Practices | European Payments Council.

Size of the elements returned in current page

Total number of pages in the backend for the list requested

Total number of elements in the list requested

Current page number

| HTTP Status | Code | Meaning |

|---|---|---|

| 401 | UNAUTHORIZED | caller doesn’t have an api-key access token |

| 403 | ACCESS_DENIED | api-key access token is invalid, creditor it's not a participant of the requested payment |

| 500 | TECHNICAL_ERROR | Technical error in Payment service |

- PREPROD merchant APIhttps://merchant.api.preprod.bancontact.net/v3/payments/search

- PROD merchant APIhttps://merchant.api.bancontact.net/v3/payments/search

- curl

- JavaScript

- Node.js

- Python

- Java

- C#

- PHP

- Go

- Ruby

- R

- Payload

curl -i -X POST \

'https://merchant.api.preprod.bancontact.net/v3/payments/search?page=0&size=10' \

-H 'Authorization: YOUR_API_KEY_HERE' \

-H 'Content-Type: application/json' \

-d '{

"from": "2019-08-24T14:15:22Z",

"to": "2019-08-24T14:15:22Z",

"paymentStatuses": [

"PENDING"

],

"reference": "19848995"

}'Endpoint delete-payment can be used to cancel a created payment that is still in status PENDING. The endpoint can also be used to cancel a payment in IDENTIFIED status, as long as the consumer has not initiated payment confirmation.

id(string, required) — Payconiq Payment Id

| HTTP Status | Code | Meaning |

|---|---|---|

| 401 | UNAUTHORIZED | user doesn't have an access token |

| 403 | ACCESS_DENIED | access token is invalid |

| 403 | CALLER_NOT_ALLOWED_TO_CANCEL | if caller is not a participant of the payment |

| 404 | PAYMENT_NOT_FOUND | payment is not found in the system |

| 422 | PAYMENT_NOT_PENDING | payment is not in pending or identify state |

| 500 | TECHNICAL_ERROR | Technical error in Payment service |

- PREPROD merchant APIhttps://merchant.api.preprod.bancontact.net/v3/payments/{id}

- PROD merchant APIhttps://merchant.api.bancontact.net/v3/payments/{id}

- curl

- JavaScript

- Node.js

- Python

- Java

- C#

- PHP

- Go

- Ruby

- R

- Payload

curl -i -X DELETE \

'https://merchant.api.preprod.bancontact.net/v3/payments/{id}' \

-H 'Authorization: YOUR_API_KEY_HERE'